Overview

Business: Financial services provider

Size/structure: 28 employees

Goal: Improve CX, EX, and team leader insight.

Solution: AI integration to augment, automate, and assist administration.

Stack: OpenAI Agent SDK and Assistant API, Lovable, Replit, and GitHub.

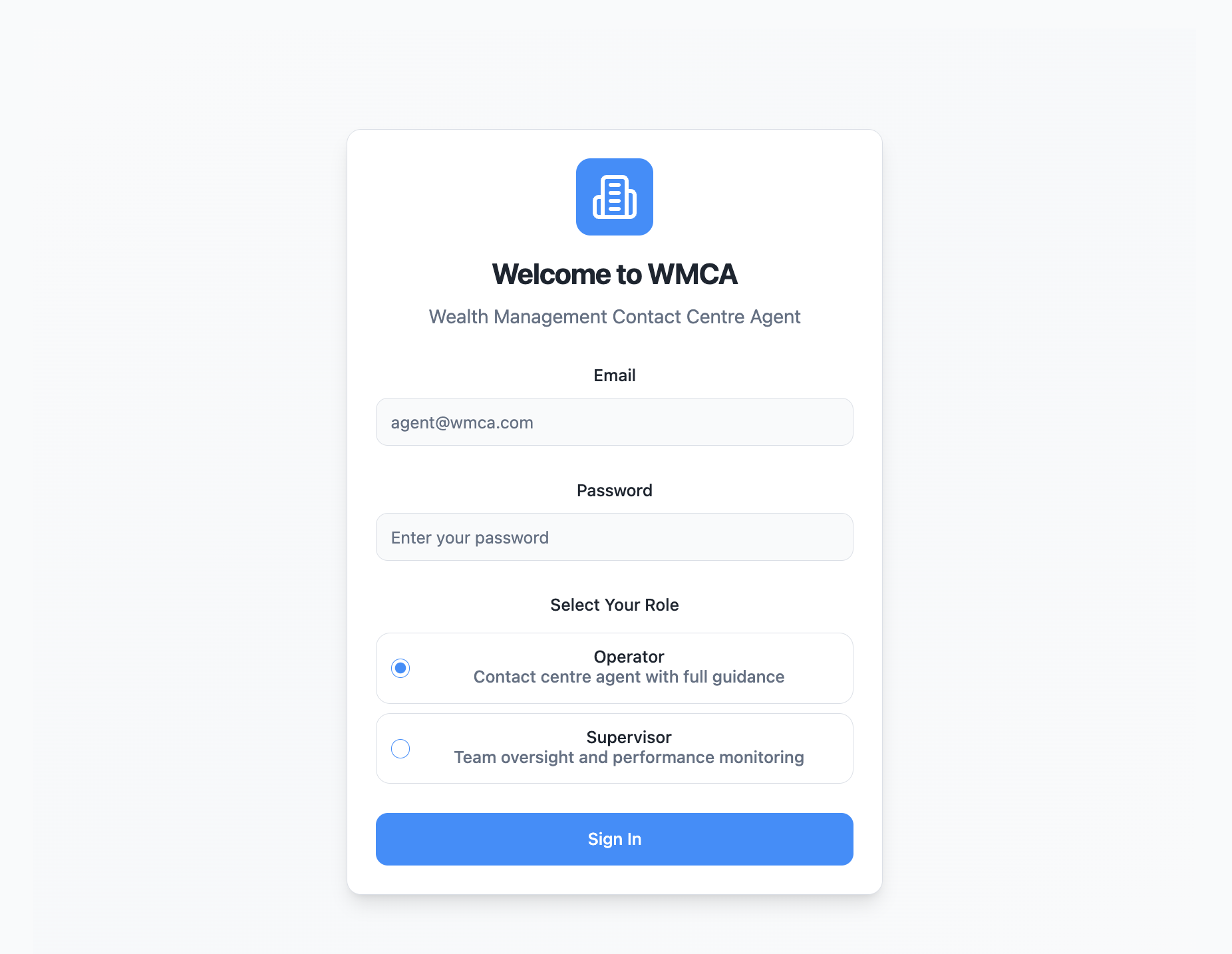

This project builds on five AI-enabled processes for a financial service designed in 2024 where the client wants to automate, assist, and augment contact centre operational processes involved in client service delivery using today’s agentic AI technology. The OpenAI Agent SDK and Assistant API were used to create backend workflows, combined with a simple Lovable interface and Replit middleware.

Analysis

The 2024 finance AI adoption case study demonstrated clear opportunities for improving customer and employee experience through AI-enabled tools, but it also exposed structural limitations in how those tools were deployed. Prototypes such as FAQs, chatbots, knowledgebases, quote generators, and performance dashboards operated in isolation, requiring staff to switch contexts, interpret outputs manually, and manage compliance independently. This fragmentation increased cognitive load, limited real-time usefulness during live calls, and introduced consistency and regulatory risks in a highly governed environment.

The core problem addressed in 2025 is therefore not the absence of AI capability, but the lack of an integrated, compliant mechanism to embed validated knowledge, performance support, and value-add guidance directly into frontline workflows. The challenge is to consolidate proven AI concepts into a single assistive system that enhances call-centre performance while preserving human judgment, regulatory control, and customer trust.

Objectives

Reduce cognitive load and handling time for frontline service staff

Improve first-call resolution and service consistency

Embed compliance-safe guidance into live customer interactions

Enable real-time coaching without supervisory intervention

Surface value-add opportunities ethically and contextually

User Personas

Client

Seeking timely, accurate, and trustworthy assistance with financial enquiries, often during time-sensitive or high-stakes personal situations.

As a client, I want clear, accurate answers to my questions during my first call, so that I feel confident I am receiving reliable information without delays or conflicting explanations.

As a client, I want to interact with an operator who is calm, clear, and structured, so that even complex or stressful financial enquiries feel easy to understand and professionally handled.

As a client, I want to be informed about relevant products or options only when they genuinely apply to my situation, so that any recommendations feel helpful rather than intrusive or sales-driven.

Contact Centre Operator

Responsible for handling client enquiries accurately and efficiently while adhering to regulatory, procedural, and service-quality requirements.

As a contact centre operator, I want instant access to verified, compliant answers during a call, so that I can respond accurately without placing the client on hold or searching systems.

As a contact centre operator, I want real-time prompts on tone, structure, and procedural steps during a call, so that I can maintain service quality and confidence while handling complex or sensitive enquiries.

As a contact centre operator, I want contextual prompts highlighting relevant value-add options, so that I can identify appropriate cross-sell or upsell opportunities without sounding scripted or breaching compliance.

Team Leader

Overseeing service quality, compliance, and staff performance, responsible for coaching and continuous improvement within the contact centre.

As a team leader, I want a single, governed source of truth for frontline knowledge, so that service delivery is consistent across operators and no longer dependent on individual experience or informal guidance.

As a team leader, I want aggregated performance signals derived from live call support, so that I can identify coaching needs and quality risks proactively rather than through manual call reviews.

As a team leader, I want visibility into when and how value-add opportunities are surfaced during calls, so that sales behaviour remains ethical, appropriate, and aligned with organisational policy.

Strategy

The 2025 strategy draws on financial-services AI guidance emphasising assistive, not autonomous, deployment in regulated environments, particularly within customer service and advisory contexts research highlights that gen-AI value in finance is maximised when tightly constrained by knowledge boundaries, explicit disclaimers, and escalation rules rather than open-ended reasoning.

Building on the 2024 prototypes, which demonstrated demand for faster information access, structured guidance, and consistent service quality, the 2025 design prioritises embedded augmentation. Instead of replacing judgment or decision-making, the agent standardises information delivery, reinforces compliant language, and supports staff performance in real time. This approach aligns with best-practice recommendations to treat AI as a frontline enablement layer, reducing operational risk while improving CX and EX simultaneously.

Solution Design

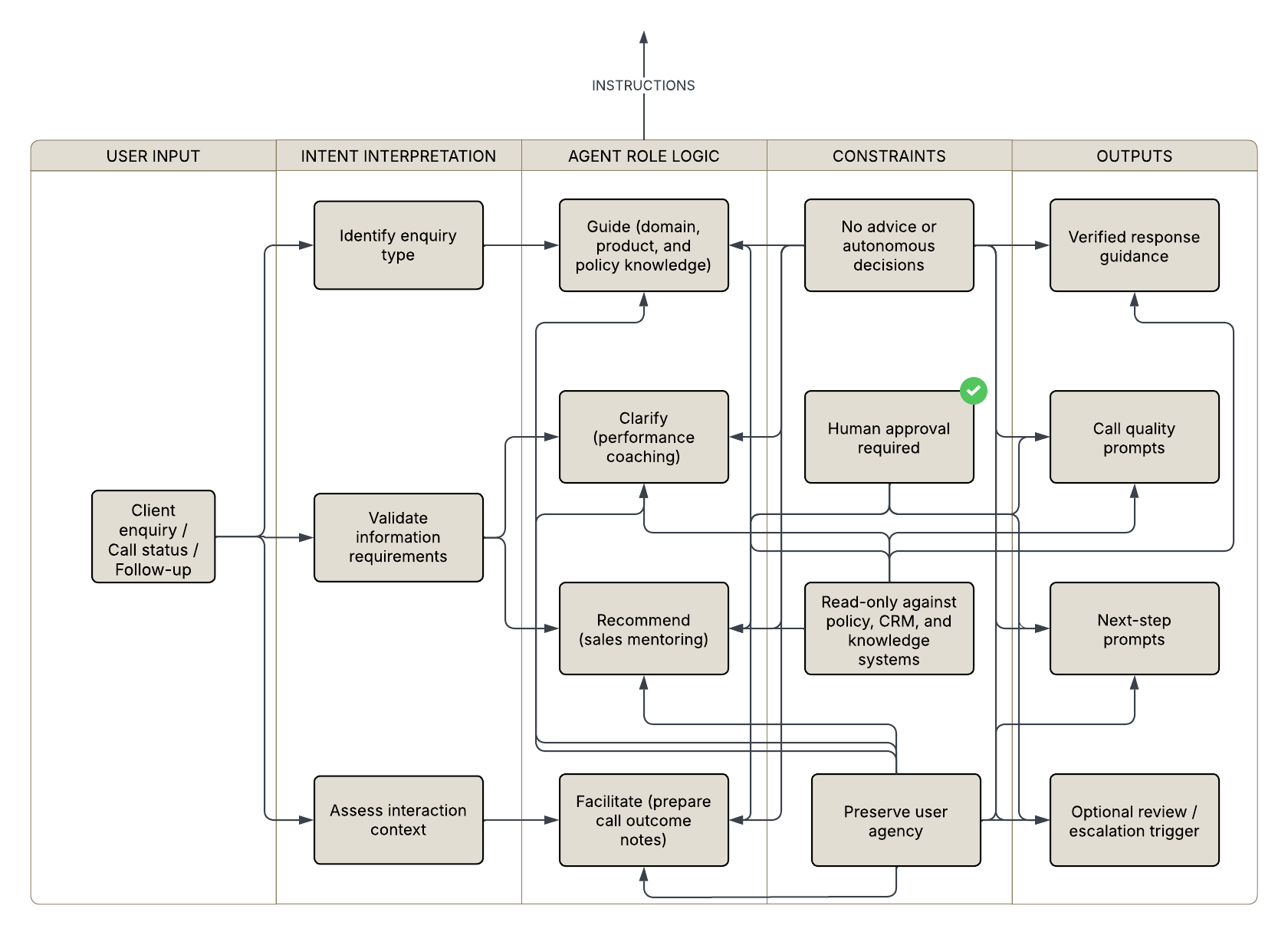

AI Agent Scope & Role

The financial services admin agent is designed as an assistive, in-call augmentation system rather than an autonomous decision-maker. Its scope is deliberately constrained to three complementary roles - subject matter expert, performance coach, and sales mentor, each activated contextually during a live customer interaction. This scope directly evolves from the 2024 prototypes, which demonstrated value in each function independently but lacked orchestration.

In 2025, these roles are unified within a single agent to support continuity of conversation, reduce cognitive load, and embed compliance-safe guidance directly into frontline workflows. The agent is explicitly positioned to support operator judgment, not replace it, reflecting regulatory expectations in financial services and lessons learned from earlier experimentation with chatbots and automated tools.

Instruction Logic

Data & Knowledge Preparation

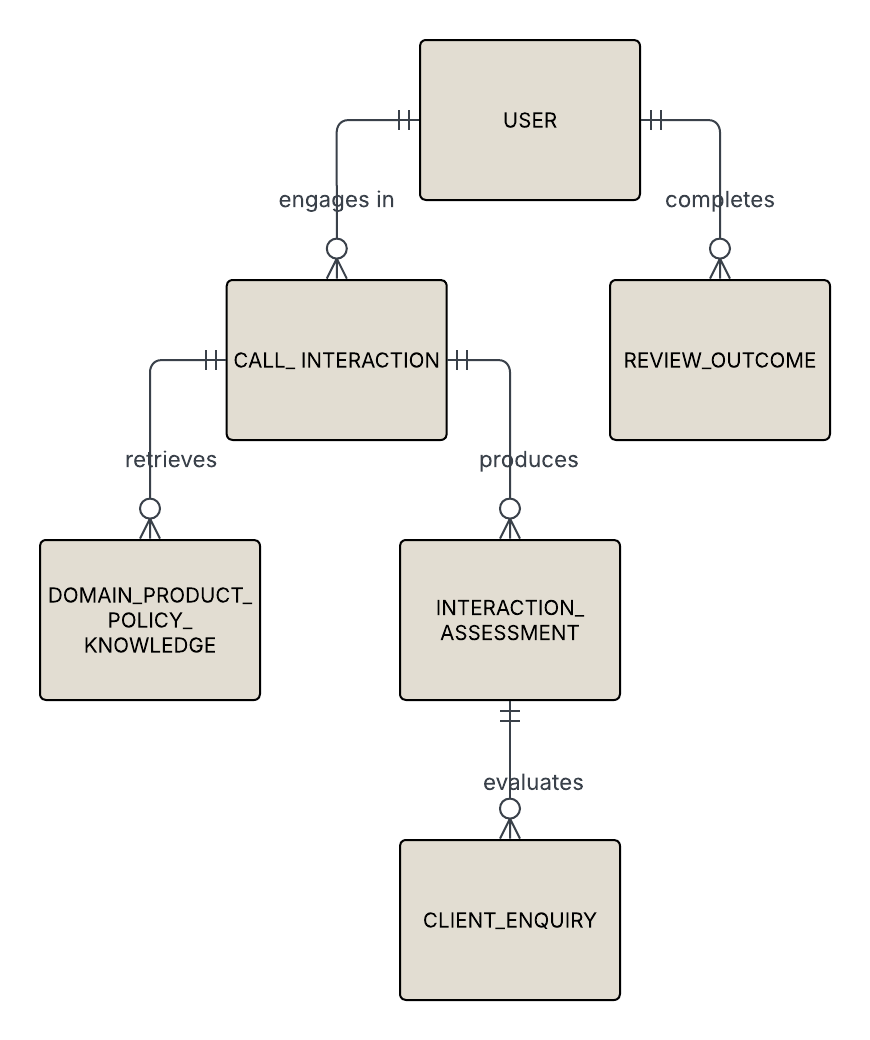

Data and knowledge preparation formalises assets that were previously implicit or fragmented across the 2024 prototypes. Core entities, such as enquiry type, knowledge topic, compliance requirement, and value-add trigger, are explicitly modelled to ensure deterministic and auditable agent behaviour.

Knowledge content is structured hierarchically by topic sensitivity, with each node mapped to required actions including factual response, disclaimer insertion, referral, or escalation. This approach evolves the earlier FAQ and staff knowledgebase work into a governed system suitable for real-time use. By externalising knowledge rules and boundaries, the design ensures consistency, reduces compliance risk, and enables future maintenance without redesigning the interaction layer.

Data Model

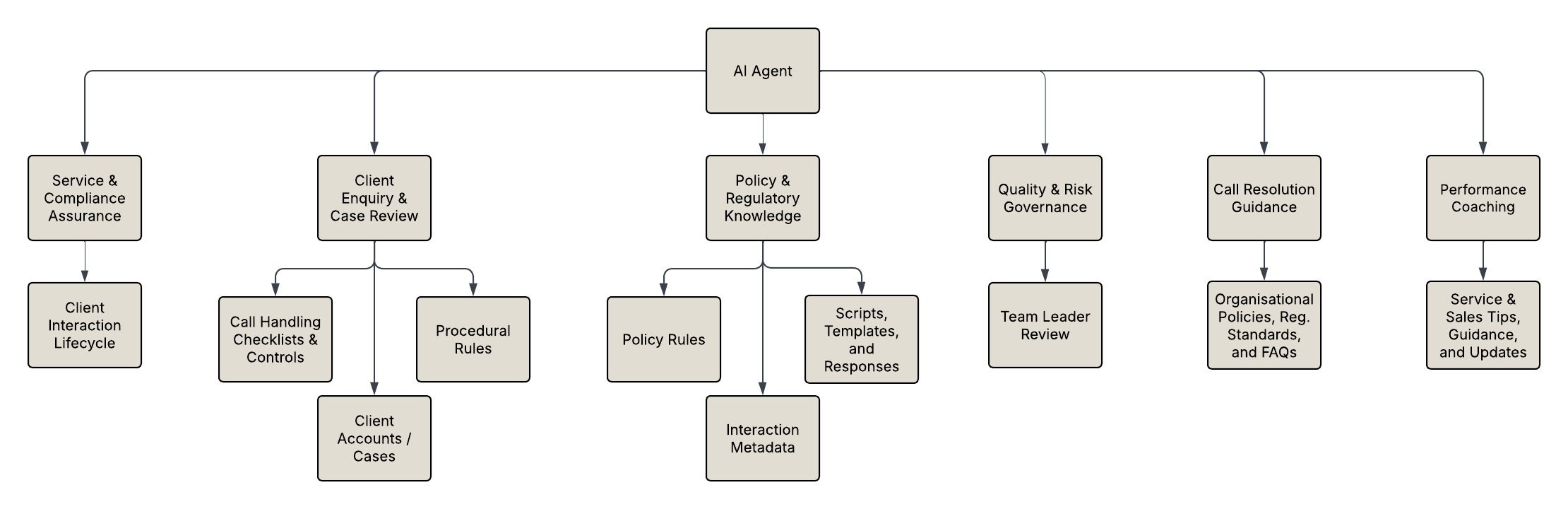

Knowledge Structure

Interaction Design

Interaction design prioritises in-call usability, reflecting insights from the 2024 case study that tools must operate during live conversations to deliver meaningful value. Rather than linear flows, the agent supports dynamic role switching as call context changes, moving seamlessly between information provision, coaching prompts, and value-add guidance.

The interface presents information progressively, surfacing only what is relevant at each moment to avoid cognitive overload. Coaching and sales prompts are designed as optional, contextual cues rather than prescriptive scripts, preserving operator autonomy. This design directly addresses limitations observed in earlier standalone tools, where staff were required to interpret outputs independently or switch systems mid-call.

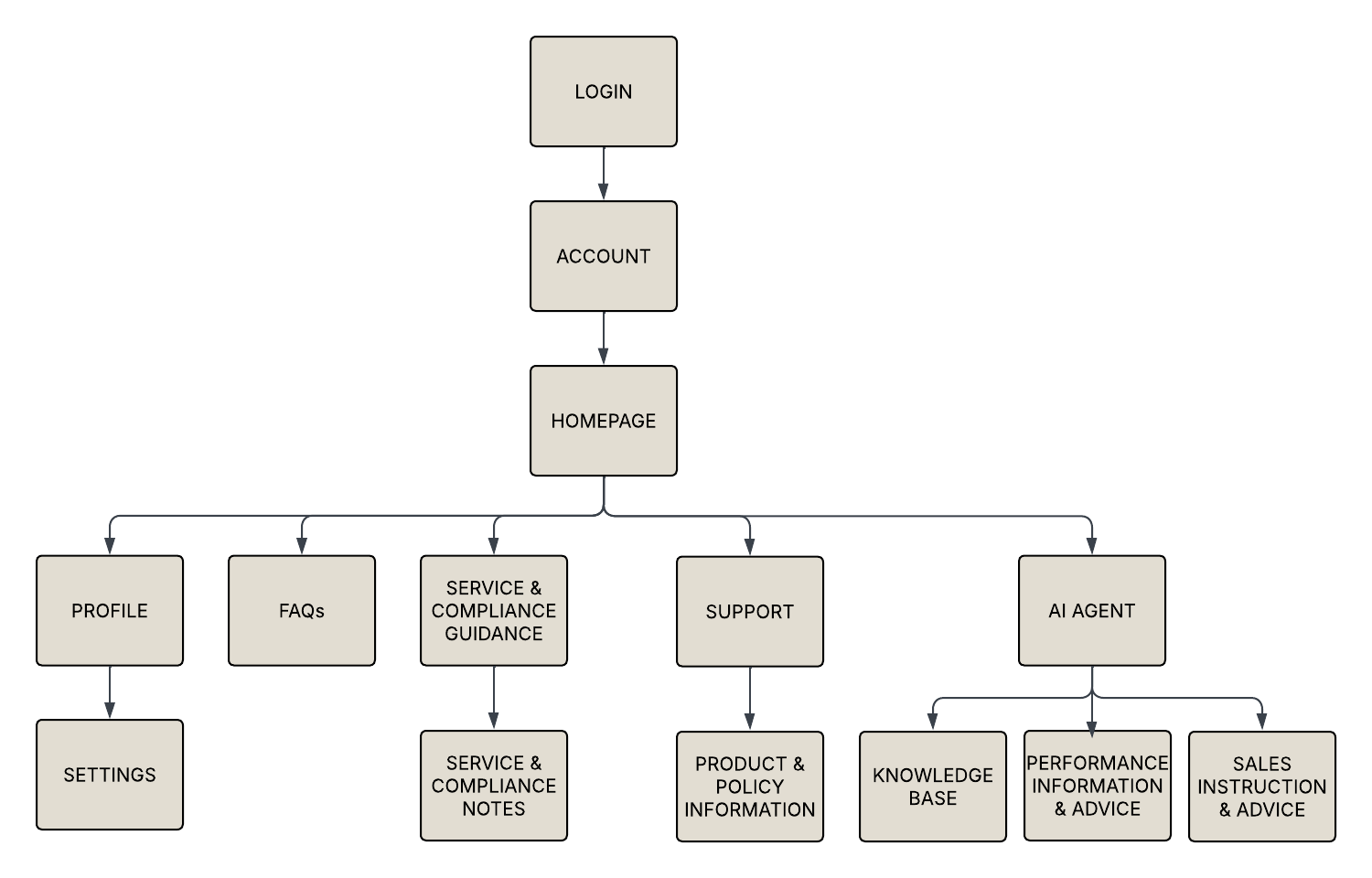

Information Architecture

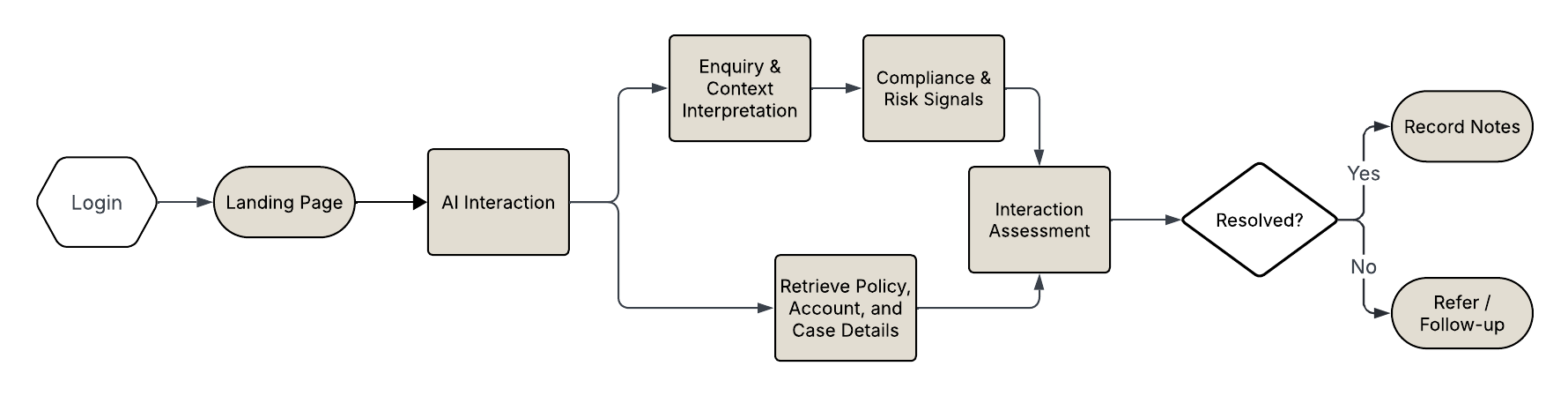

User Flow

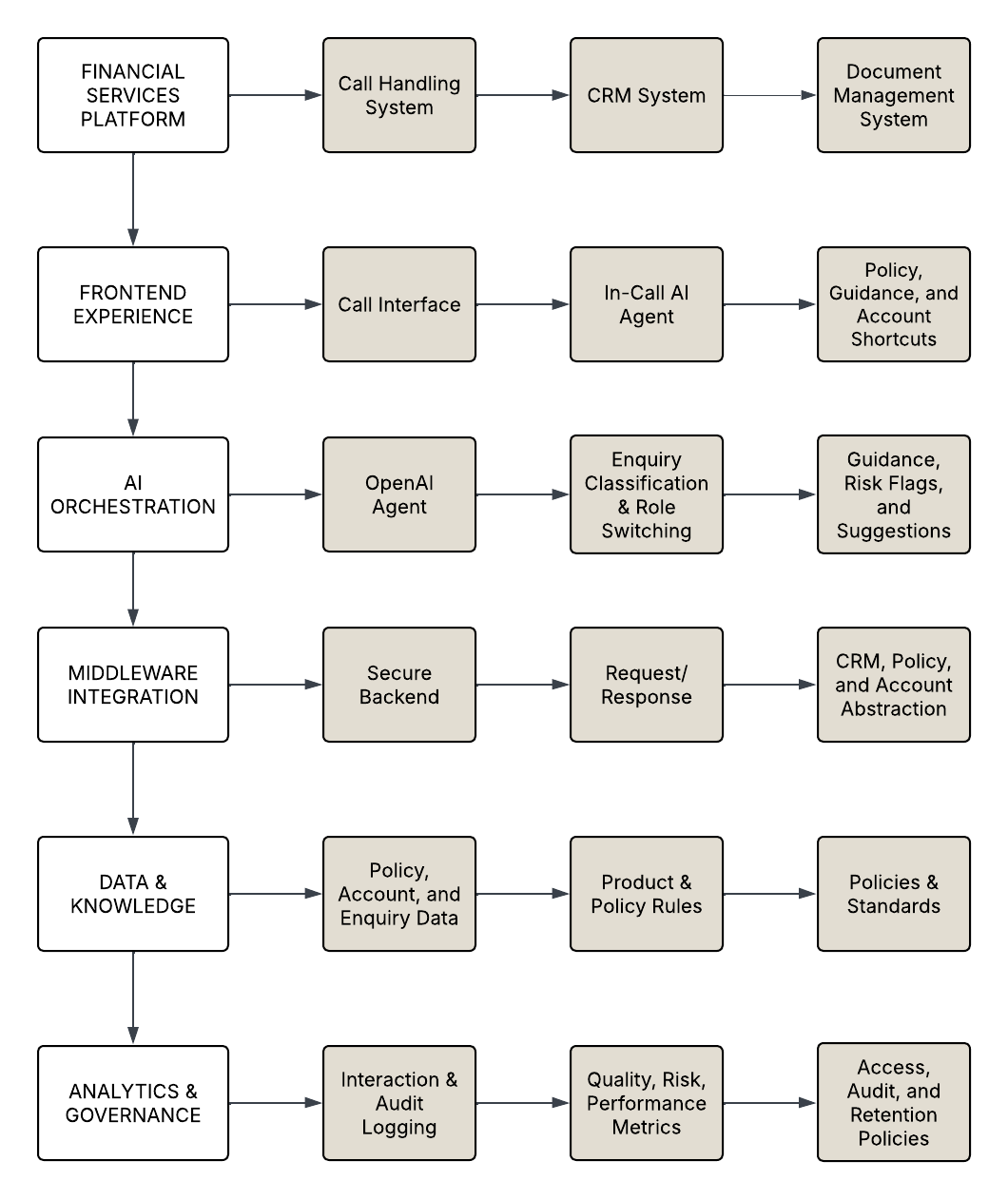

Technical Integration

From a technical perspective, the solution consolidates previously separate tools into a single integration layer that can sit alongside existing contact centre systems. While the 2024 work focused on feasibility within third-party platforms, the 2025 design abstracts the agent logic from any single vendor, enabling portability and future extensibility.

Agent instructions, knowledge rules, and role logic are externalised from the interface, supporting governance, auditability, and iterative improvement. This integration strategy reflects a shift from prototype experimentation to production readiness, ensuring the solution can scale incrementally while maintaining regulatory control and operational stability.

Tech Stack

Results

The 2025 admin agent demonstrates a measurable improvement over the fragmented 2024 prototypes by consolidating functionality, reducing handling friction, and improving consistency across simulated testing scenarios. Staff testing indicated faster information retrieval, reduced reliance on supervisors, and improved confidence during complex enquiries. Importantly, compliance risks observed in earlier chatbot-style experiments were mitigated through structured knowledge boundaries and escalation logic. While full production metrics remain out of scope, the solution establishes a clear foundation for scalable deployment, analytics integration, and future agentic expansion aligned to enterprise governance requirements.

Use Case 1: Client

Enhanced Customer Experience

Clients benefit from shorter calls, clearer explanations, and fewer transfers. The agent ensures consistent language, timely reassurance, and accurate information delivery, directly addressing CX pain points identified in the 2024 analysis.

Use Case 2: Employee

Elevated Performance

Administrators receive real-time support without loss of autonomy, reducing stress and cognitive load while improving first-call resolution and confidence.

Use Case 3: Team Leader

Empowered Leadership

Managers gain structured performance signals and quality indicators, enabling proactive coaching and risk management without intrusive monitoring.

Limitations

The solution does not yet include persistent conversation logging, advanced analytics, or autonomous task execution. Its effectiveness is contingent on knowledge maintenance and rule updates, and it remains dependent on human decision-making for regulated outcomes. These constraints are intentional, reflecting a risk-aware deployment stage rather than technical immaturity.

Future Directions

Future development of the Financial Services Admin Agent would focus on progressing from foundational workforce augmentation toward a more mature, analytics-enabled and adaptive system, while maintaining regulatory safeguards. A first priority would be the introduction of structured conversation logging and metadata capture, enabling longitudinal analysis of enquiry types, compliance interventions, coaching prompts, and value-add outcomes. This data would support evidence-based performance management and continuous improvement without increasing supervisory burden.

A second direction involves deeper integration with enterprise CRM and contact-centre platforms to enable contextual pre-call and post-call intelligence, such as surfacing client history or generating compliant call summaries. As organisational maturity increases, selective automation of low-risk follow-up tasks may be explored, transitioning the agent from purely assistive to partially agentic in tightly governed contexts. Collectively, these directions position the solution as a scalable foundation for responsible AI adoption in financial services.

Summary

This case study demonstrates a deliberate evolution from exploratory AI adoption in 2024 to integrated workforce augmentation in 2025. By consolidating validated prototypes into a single Admin Agent, the project shifts AI from experimentation to operational capability. The design preserves human judgment while embedding compliant, assistive intelligence directly into frontline workflows, aligning with financial services best practice and enterprise AI maturity progression . Key lessons include the necessity of externalising compliance logic, the importance of role-based agent behaviour, and the value of consolidating tools before scaling autonomy. Most critically, the project confirms that successful AI adoption in financial services is evolutionary, progressing from assistive foundations toward greater autonomy only once governance, trust, and operational readiness are firmly established.

Bibliography

Australian Financial Review (2025). Westpac works with Accenture to deploy AI agents. Eyers, J. (2025). Australian Financial Review, 24 February 2025.

Bain & Company (2024). AI in financial services survey shows productivity gains across the board. Mehta, B., Salomon, O., Alves, M., and Barth, E. writing for Bain & Company, 16 December 2024.

Boston Consulting Group (2025). For Banks, the AI Reckoning is Here. Financial Institutions, AI in FI Report 2025. Riemer, S., Coppola, M., Rogg, J., Rulf, K., Schmid, C., Straub, M., and Tripathi, S. writing for Boston Consulting Group, 21 May 2025.

Deloitte (2023). Unleashing a new era of productivity in investment banking through the power of generative AI. Gopalakrishnan, S., Chauhan, A., and Srinivas, V. writing for Deloitte Insights, 27 July 2023.

Deloitte (2024). Harnessing generative AI for competitive edge in financial services. Deloitte Perspective, 30 October 2024.

Deloitte (2025). Harnessing gen AI in financial services: Why pioneers lead the way. Deloitte Insights, 26 February 2025.

McKinsey (2024). Extracting value from AI in banking: Rewiring the enterprise. McKinsey & Company, Financial Services Practice, December 2024.

Salesforce (2024). A Guide to Generative AI in Financial Services. Salesforce, 19 August 2024.

World Economic Forum & Accenture (2025). Artificial Intelligence in Financial Services. White Paper, January 2025. AI Governance Alliance, World Economic Forum in collaboration with Accenture.

Related Projects

Engineering Admin Augmentation

Architecture Admin Augmentation